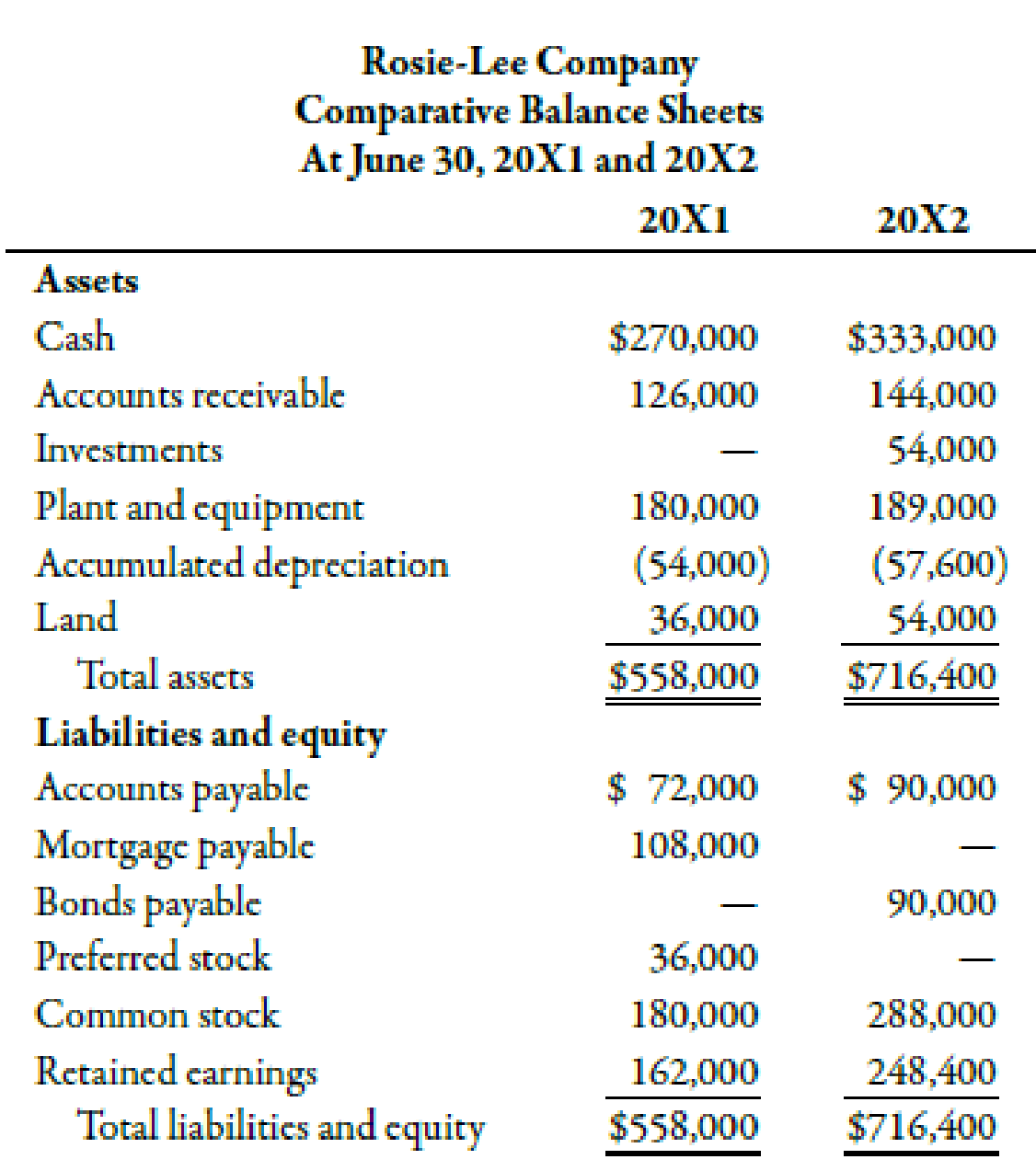

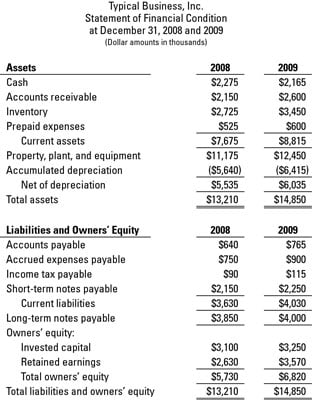

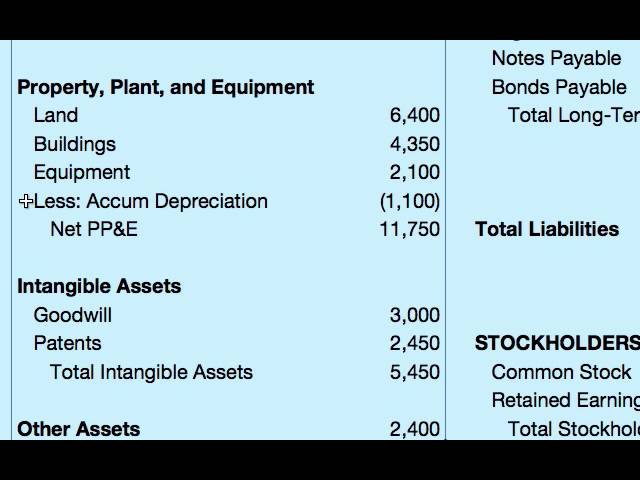

How is accumulated depreciation represented in the balance sheet? As a negative/credit asset or as a positive/debit liability? - Quora

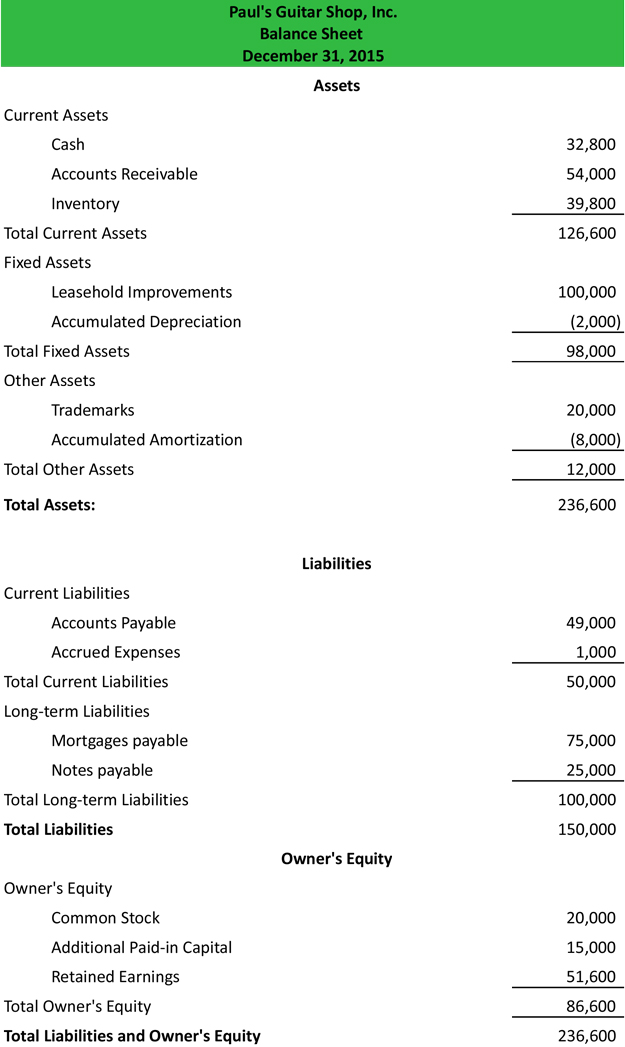

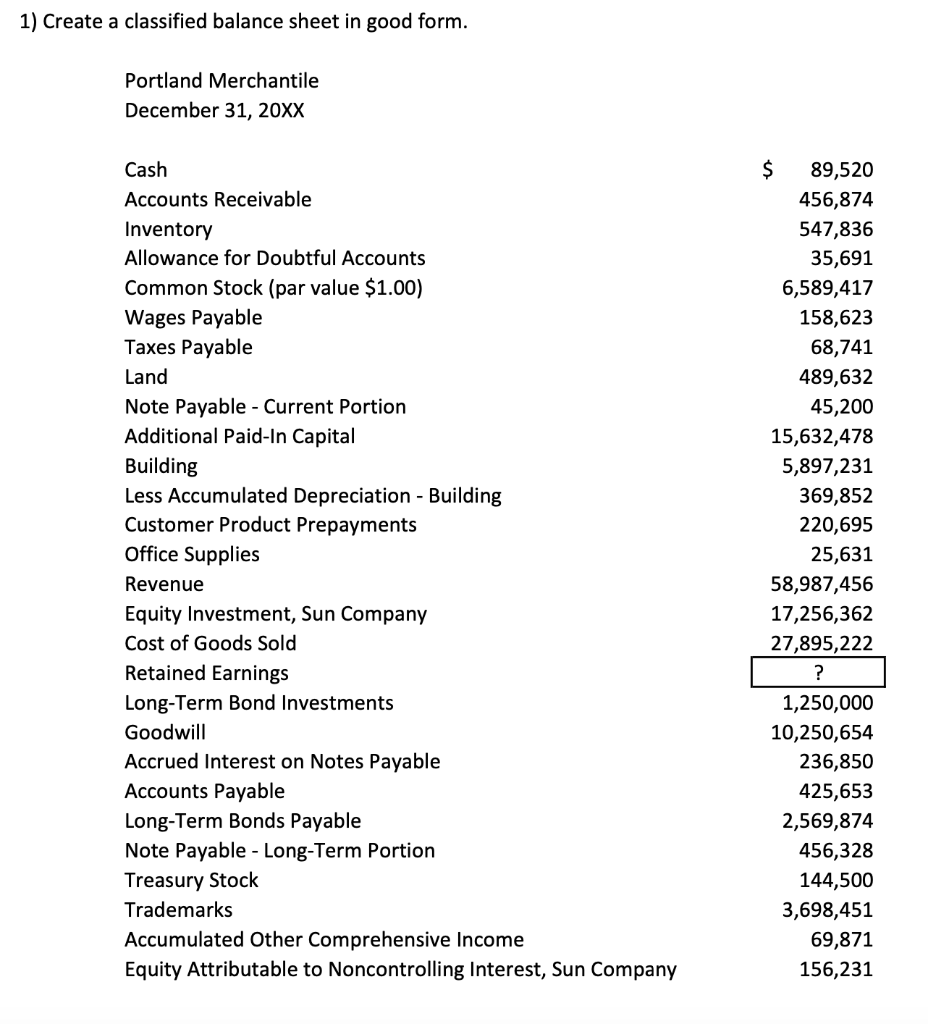

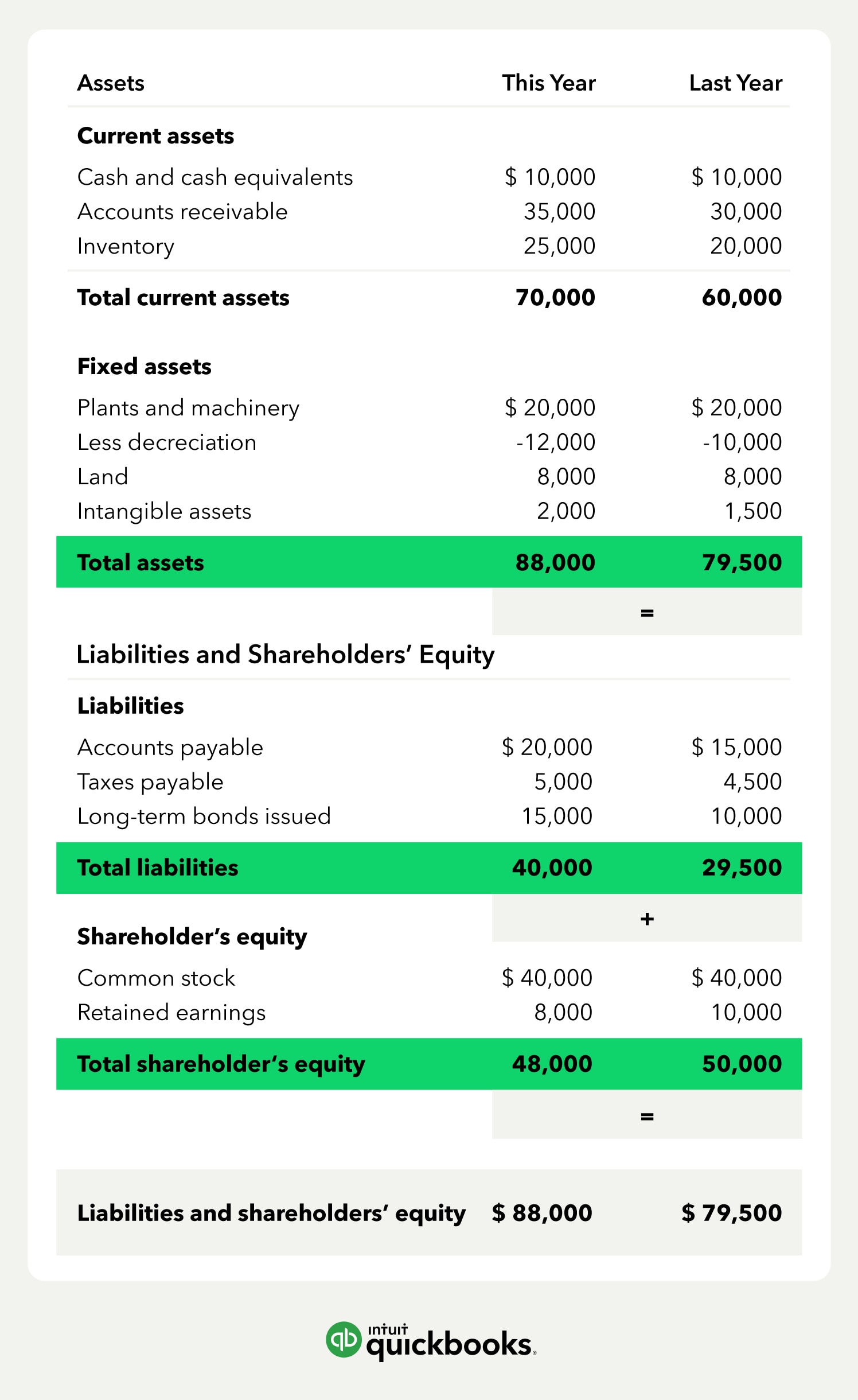

LO 4.5 Prepare Financial Statements Using the Adjusted Trial Balance – v2 Principles of Accounting — Financial Accounting

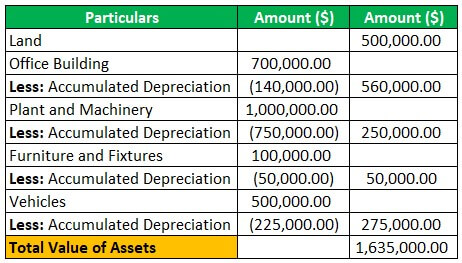

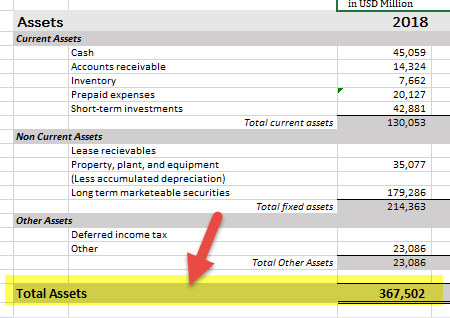

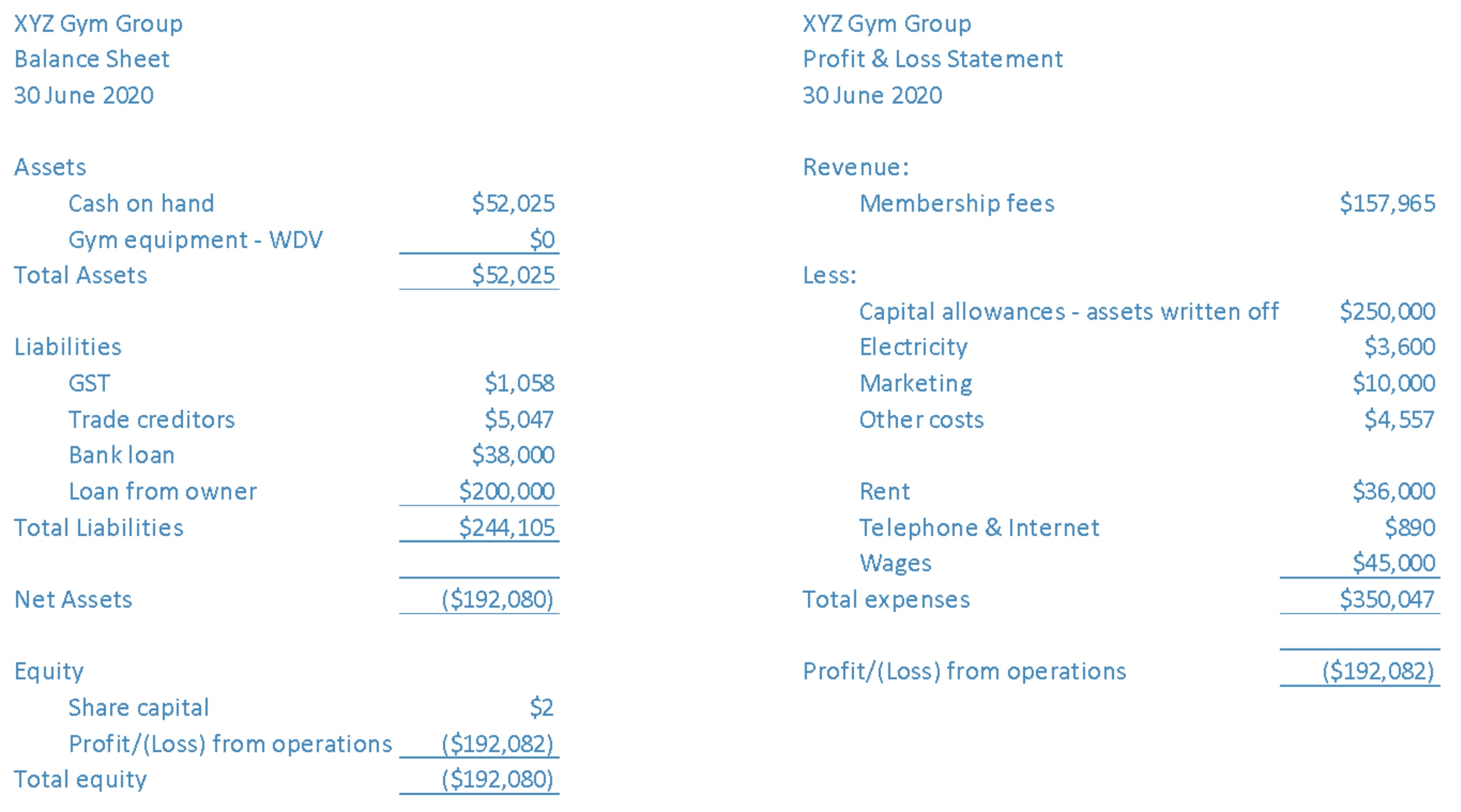

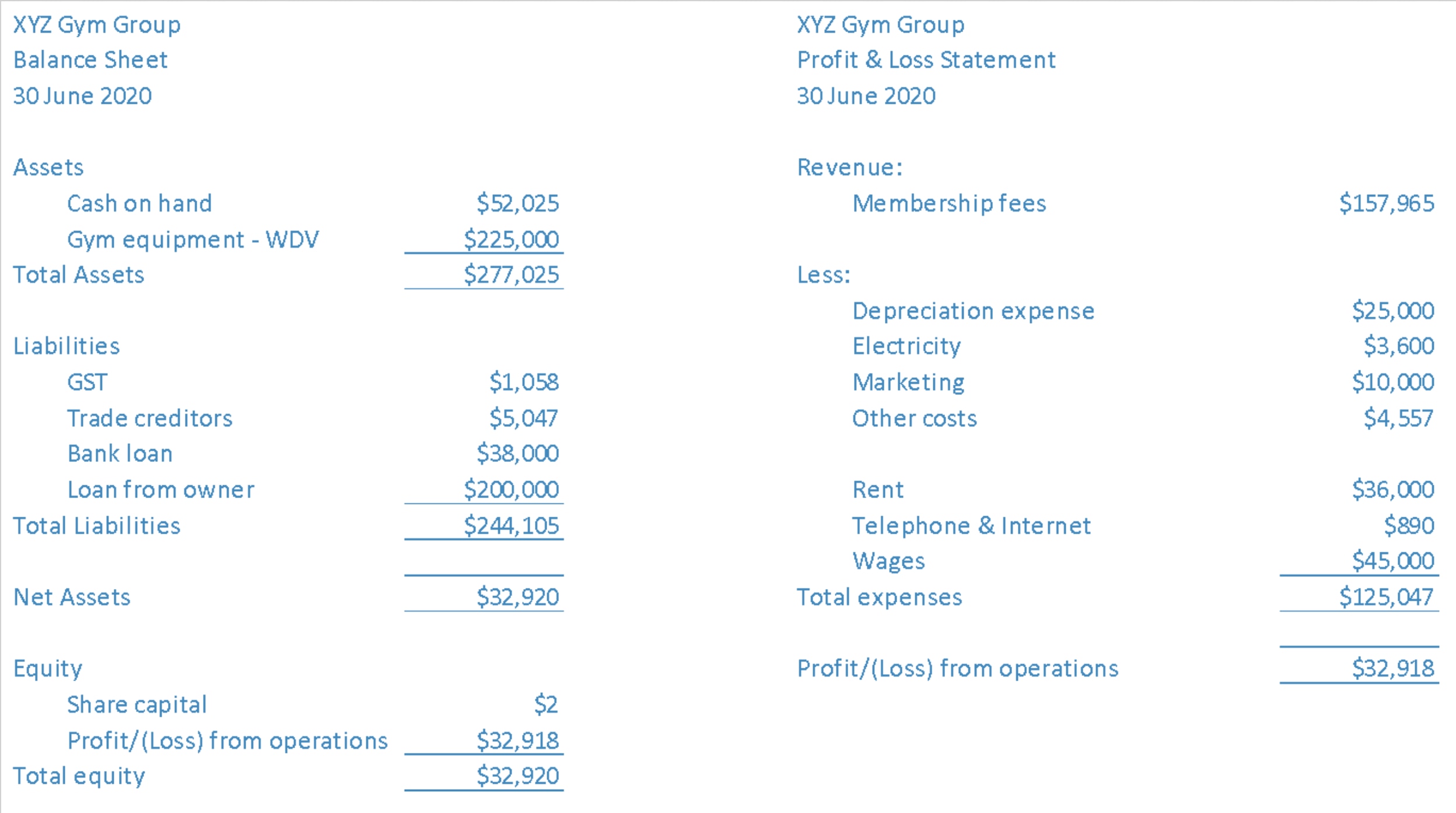

Depreciation Turns Capital Expenditures into Expenses Over Time | Income statement, Income, Cost accounting